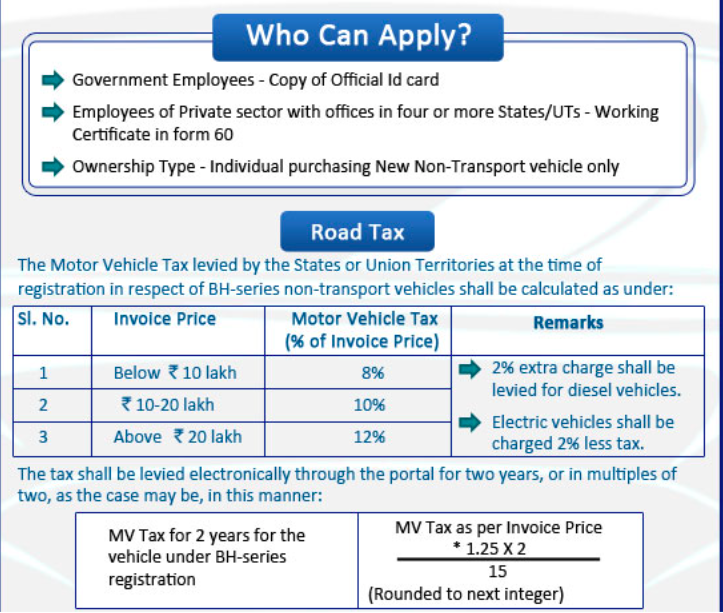

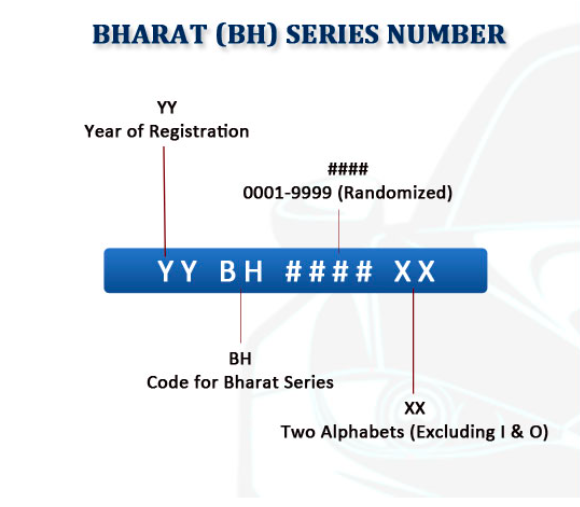

Re-registration of vehicles was one of the sore points while relocating to another state, which was eliminated after the introduction of pan India BH series number plates. Such movements create a sense of unease in the minds of such employees with regard to the transfer of registration from the parent state to another state. Under section 47 of the Motor Vehicles Act, 1988, a person is allowed to keep the vehicle for not more than 12 months in any state other than the state where the vehicle is registered, but a new registration with the new state- registering authority has to be made within the stipulated time of 12 months.

How to re-register vehicle in another state